JPMorgan \ B2B Financial software

High-converting sales tools for Financial Advisors

Head of Design: Advisor products

Overview

JPMorgan has a high volume of unauthenticated Financial Advisor traffic on their public website. I led a product team through the end-to-end design & strategy of a suite of portfolio management tools, apps & platforms for Advisors to manage their client’s investments, with the aim of capturing user data & aiding more effective sales.

Business goals:

🎯 Capture more portfolio data to help sell better matched products to Financial Advisors during their analysis workflow

🎯 Increase relevancy, and interest in JPMorgan fund suggestions

🎯 Automate and scale the high-touch sales cycle of selling JPMorgan funds to Advisors

Business impact

-

$7.2bn fund sales were influenced by FA Tools suite

A result of increasing registrations, time in products, analyses run & engagement with fund ideas

-

4 x increase in sales of promoted funds after redesign

Research-led redesign of popular investment comparison tool to increase interest and trust in fund ideas

-

20% increase in registrations after growth-optimization

Converting registered users allowed us to capture their client portfolio data & sell targeted products

Key projects & outcomes

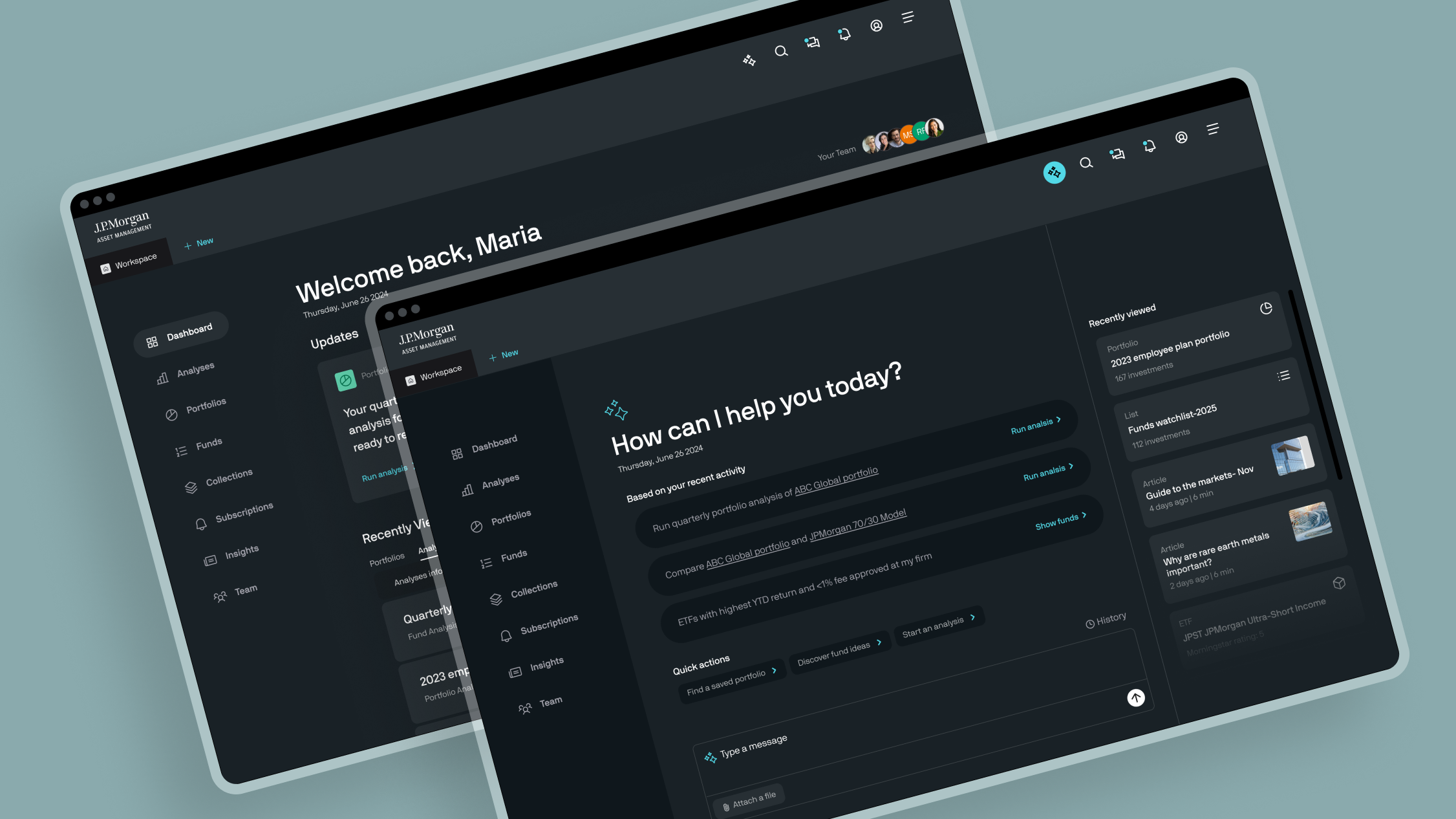

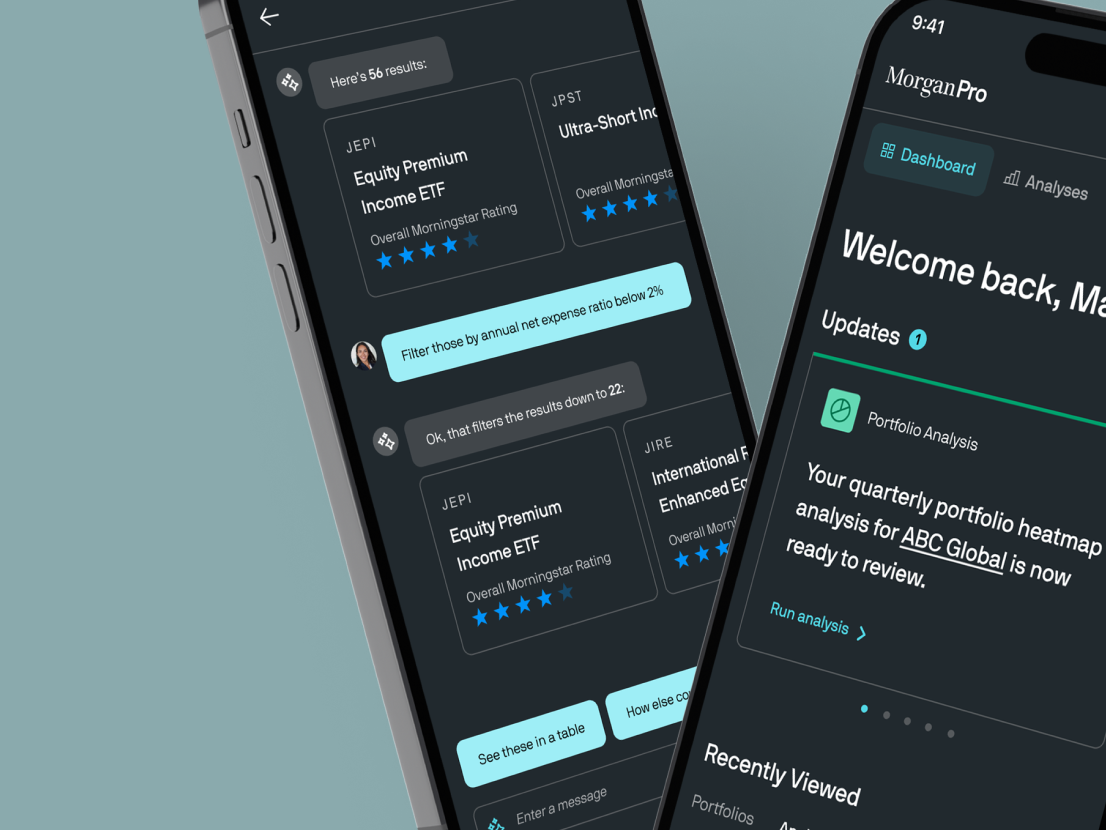

Streamlining the investment research process with an AI-first advisor workspace

Digital transformation project to explore the business impact of AI-first recommendations to help Advisors find, analyze and sell the best investments to their clients

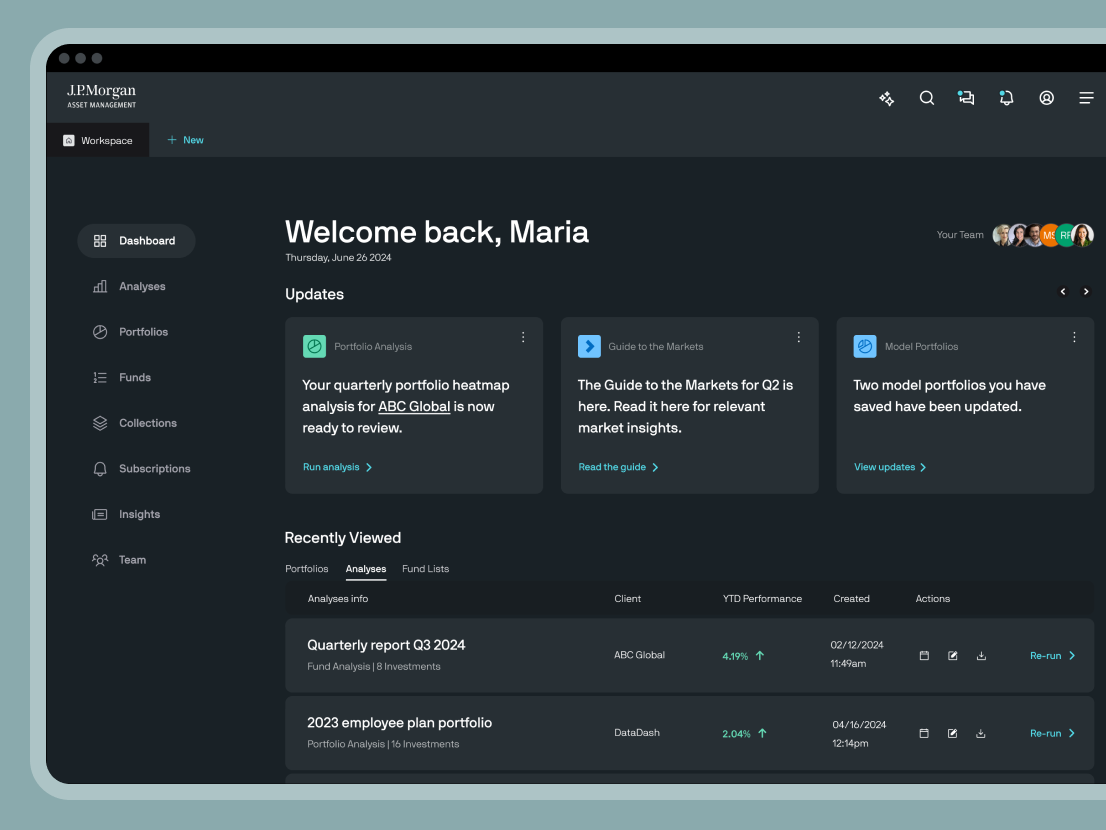

Advisor workspace dashboard

Investment assistant

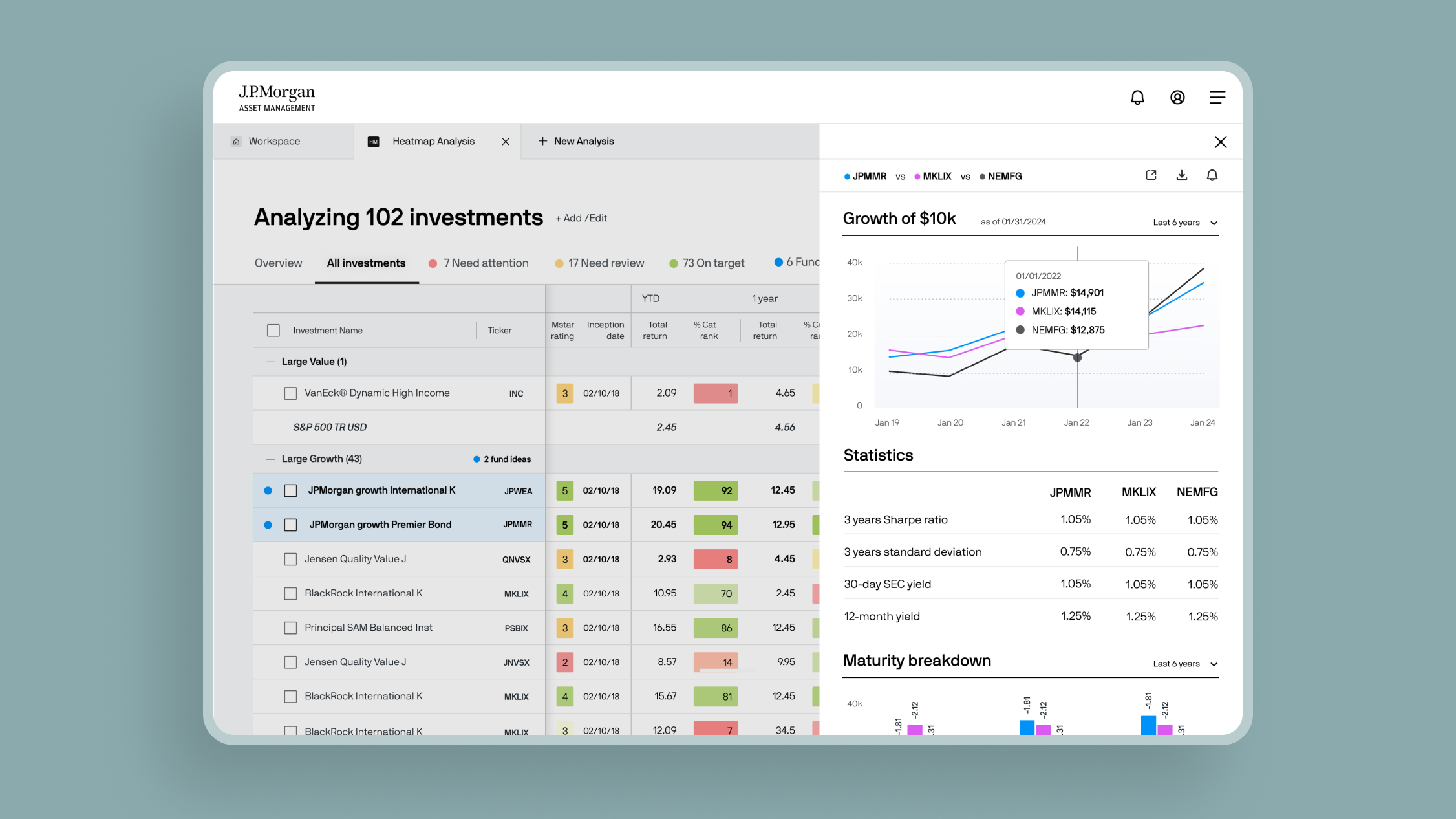

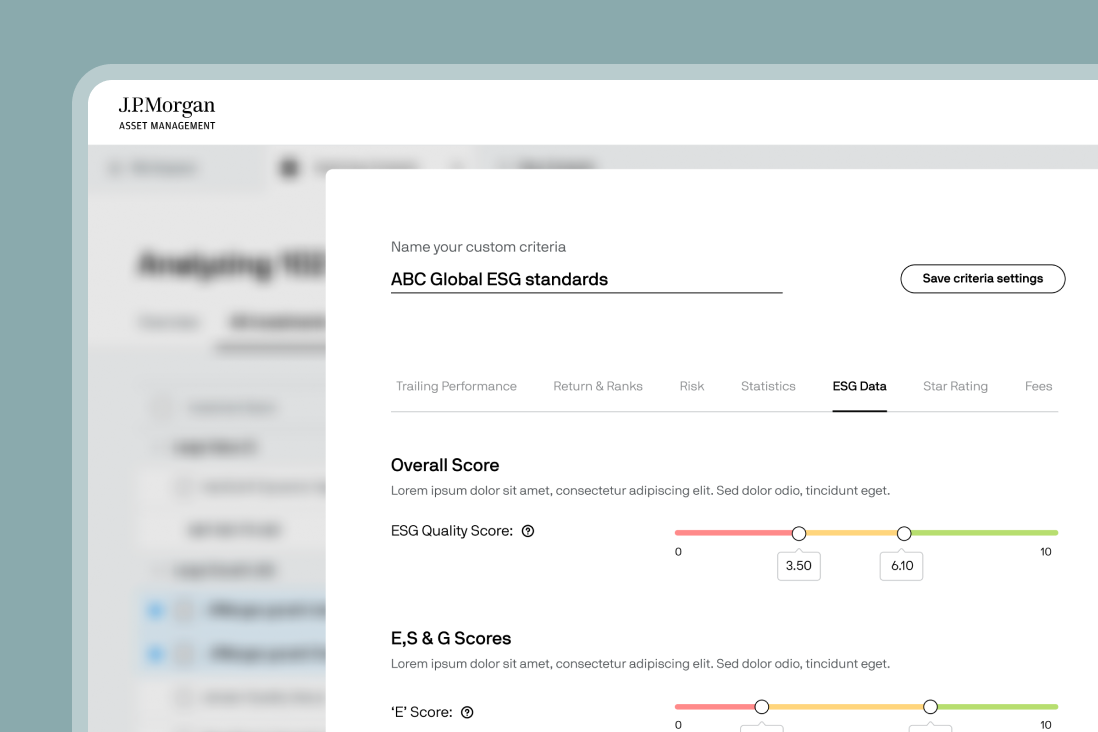

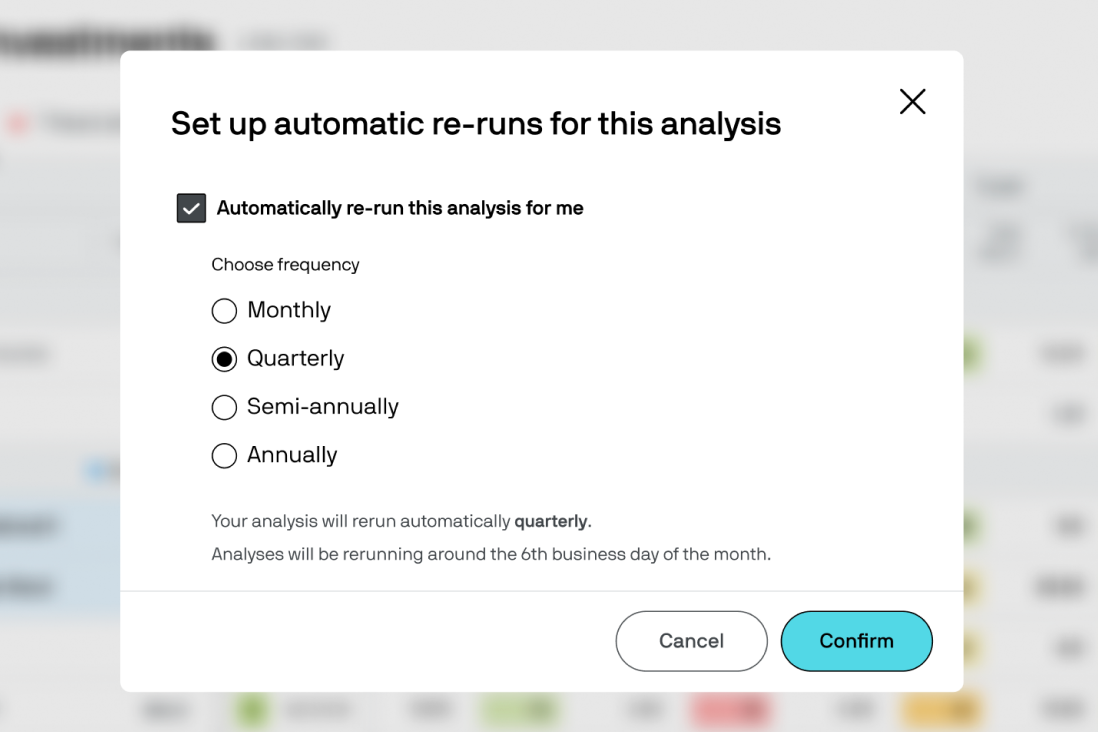

Scaling a high-touch b2b2b2c sales cycle into a direct-to-Advisor fund recommendation tool

Reducing a multi-weeks process of analyzing portfolio & making custom recommendations and allowing Advisors to analyze large data sets and see in-line ideas for better performing JPM products, based on their specific firm-standards or client needs. Users can customize their recommendations and analysis criteria.

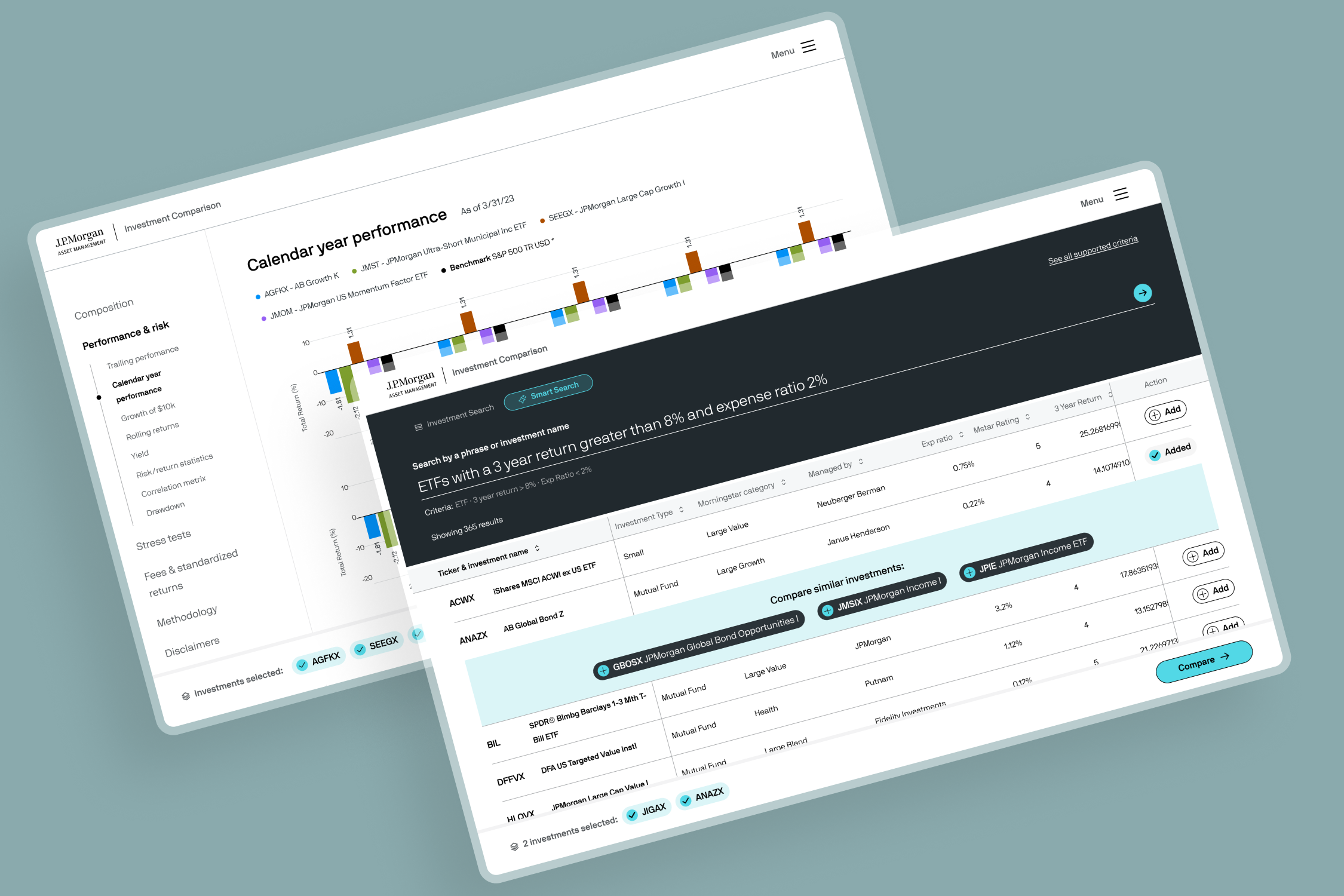

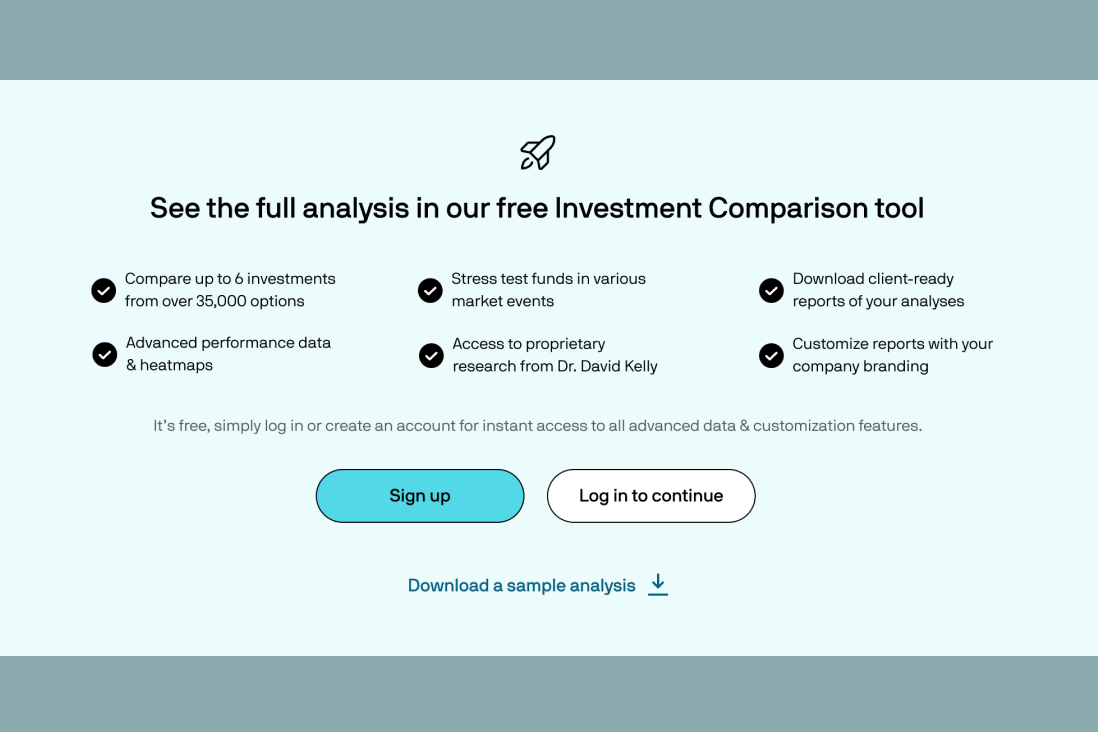

Redesign of fund comparison tool lead to a 4x increase sales of in-app promoted funds

Optimizing for discovery & comparison of JPMorgan similar & out-performing products saw a 400% increase in users comparing & buying the products.

Product before

Product after

Growth sprints to learn, test & iterate on product adoption & acquisition saw 20% increase in registrations

We tested language and sign up mechanics to increase registrations to Advisor analysis tools by 20% year-over-year.

Version 1: Goal of getting sign ups (performed badly)

Version 3: Goal of capturing email (performed well)